Leading with a Data-First Mindset in Fintech: The Currency of Success in the Age of AI

By Darton Rose, Principal, Data Solutions, Wolf & Company Success depends on making the most of one of our most valuable assets:...

Blog The world needs FinTech like never before

Mar 13, 2024

Ever wondered how the fintech ecosystem can play a part in tackling climate change? A new report, Climate FinTech: An innovation thesis, from Rise, created by Barclays, highlights how one area of our industry could emerge to drive greater adoption of low-carbon solutions and technology.

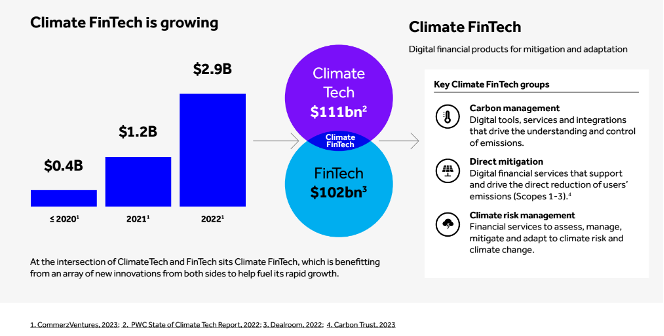

That area is what Rise has identified as Climate FinTech. Climate FinTech describes organizations that build products leveraging a combination of climate, finance and technology solutions that support climate change mitigation and adaptation. Climate FinTech products can range from quantifying a carbon footprint to embedding financing within a climate solution. The companies innovating in this space are addressing the significant challenges faced by both consumers and businesses, who find that switching to low-carbon solutions can be painful due to adoption barriers that include upfront costs and technical complexity.

“Reaching at least 50% carbon reductions currently costs about $55,000 for a typical single-family home” — Research performed by the University of California, Berkeley

“US Department of Agriculture agency set aside nearly $3bn to give to farmers who cut emissions, but about $1.9bn spent on practices not doing that” — The Guardian

Climate FinTech can make that switch more affordable and simpler than it is today. Solutions can be grouped into three themes:

Persefoni, based in Arizona, have developed a climate management and accounting platform to support businesses and financial institutions in meeting climate disclosure requirements.

Banyan, based in California, helps finance sustainable projects such as solar, wind or other renewable energy initiatives by connecting banks, lenders and developers.

Agcor, based in California, uses data science and machine learning to support the agricultural economy with risk management and water intelligence.

According to our report, this sector is growing at speed with over $2.9B of investment in 2022 with Carbon Management related companies receiving the vast majority of investment. Direct Mitigation, however, received only 11% of total investment. Our analysis shows that Direct Mitigation could be the key area to unlock significant emissions reduction and commercial gain with the right support and financing compared to the other two themes.

Through our fintech focussed Rise, created by Barclays proposition, we provide Climate FinTechs with the tools to engage, network and experiment with the bank and other top innovators to support growth in this area. We offer:

If you are an early-stage Climate FinTech founder solving a problem across our three Climate FinTech thesis areas, check out our 10-week digital Rise Start-up Academy: Climate FinTech Edition. Across the programme, start-ups will fine-tune their product, get to grips with the foundations of pricing, understand how to increase sales and learn how to build out their team. As well as developing a repeatable and scalable business model.

Key Dates

For more information and to apply — https://rise.barclays/rise-startup-academy-climatefintech-edition/

By Darton Rose, Principal, Data Solutions, Wolf & Company Success depends on making the most of one of our most valuable assets:...

New Sponsors and Data Partners Part 1 of our review of the first six months of 2024 covered the 19 startups we...

A guest blog post from our friends at Rise, created by Barclays. Ever wondered how the fintech ecosystem can play a part...