The Q&A from Demo Day 11

Last week, at our 11th Demo Day, we saw five fintech innovators succinctly showcase their solutions to the most pressing challenges in...

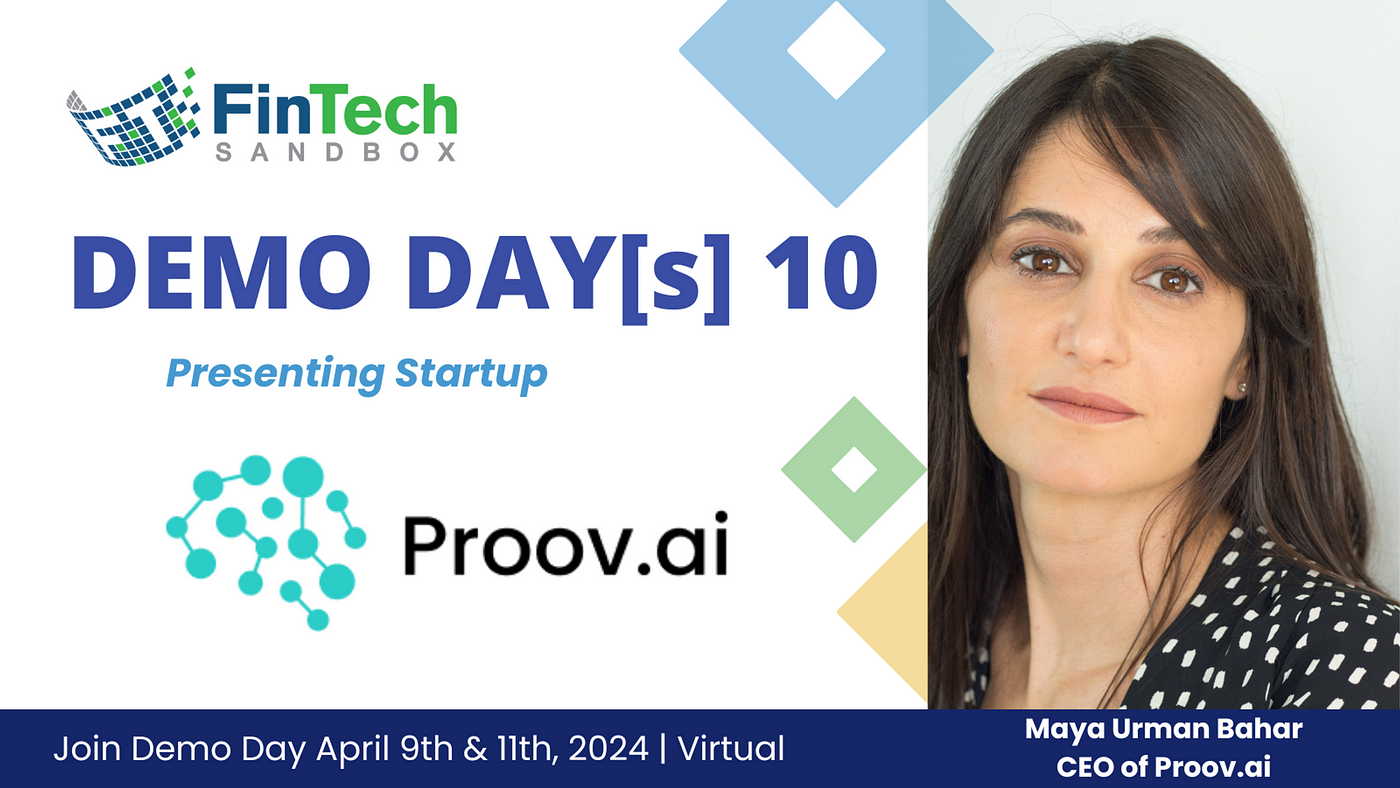

Blog Meet Proov.ai — A Demo Day[s] 10 Presenting Startup

Apr 02, 2024

This year, FinTech Sandbox Demo Day[s] will take place across two days, April 9 & April 11. The presentations will be virtual and the event, as always, is free. Demo Days are exciting because we get to showcase startups that are on the very cutting edge of innovation and you get to see what they’re up to before they’re discovered.

Today, we’re talking to Maya Urman Bahar, Co-Founder & CEO of Tel Aviv based Proov.ai. Bridging the gap between data science and compliance teams, Proov.ai disrupts fintech regulation with automated model validation, revolutionizing Model Risk Management for banks. Proov.ai is presenting on Thursday, April 11.

Q. Maya, tell us a bit about Proov.ai. What problems are you solving?

A. All Models in financial institutions need to be governed to meet regulations. The approval process is lengthy, costly, manual and unorganized. FinTech Data Science teams are forced to constrain and compromise the accuracy of the models to meet regulatory review requirements.

Q. What is your company’s origin story?

A. Einat and I, having worked together at a fintech company, encountered the widespread challenge of a lengthy and costly model approval process, which not only compromised the accuracy of our models but also directly impacted the company’s bottom line. Recognizing the inefficiency and unsustainability of the current approach in the era of AI, we were inspired to set out on a mission to revolutionize Model Risk Management (MRM).

Q. Can you describe what it’s been like to be part of the Fintech Sandbox community?

A. It is amazing to be part of such a group of accomplished people!

Q. Why is data access important to your startup?

A. Data access is essential to our startup as it allows us to create synthetic data using Generative Adversarial Networks (GAN). We require access to diverse types of data, including bureau, transactional, and demographic data, to generate synthetic datasets that accurately represent real-world scenarios. Synthetic data is crucial for maintaining security, ensuring privacy, and simulating extreme conditions without risking sensitive information. This approach enables us to train our models effectively and develop robust solutions for model validation.

Q. What milestones has Proov.ai achieved so far?

A. We developed our first phase of the product. Are working on a POC with a BAAS provider.

Q. What trends in fintech are you most excited about?

A. Gen-AI and LLMs.

Q. How does Proov.ai think about leveraging AI in a differentiated way?

A. Our company takes a differentiated approach to leveraging AI by focusing on the core use of AI technology in our platform:

1. Generative Adversarial Networks (GAN): We utilize GANs to generate synthetic data, creating diverse datasets that closely represent real-world data. This synthetic data forms the foundation for testing against various protected features, ensuring the robustness and fairness of our models.

2. Comprehensive Training Data: We train our models on comprehensive datasets, including bureau, transactional, and demographic data. This enables us to develop more accurate and reliable models.

3. Deep Learning: We employ deep learning techniques to conduct stress tests and fairness assessments at a very deep level. This allows us to evaluate the resilience and equity of our models under various scenarios, ensuring their reliability.

4. Large Language Models (LLMs): Our platform leverages LLMs to generate insightful documentation. This streamlines the communication and decision-making processes.

Q. What’s next for Proov.ai?

A. As our technology continues to evolve, with a current focus on Gen-AI-based documentation, our primary goal is to gain traction by broadening our reach and onboarding additional banks and fintech partners. We are also exploring new ways to enhance our platform’s capabilities and deliver even more value to our clients.

To hear more about Proov.ai and 11 other exciting fintech startups, be sure to register for FinTech Sandbox Demo Day[s] 10!

Last week, at our 11th Demo Day, we saw five fintech innovators succinctly showcase their solutions to the most pressing challenges in...

This year, Fintech Sandbox Demo Day will take place on April 28. The presentations will be virtual and the event, as always, is free....

This year, Fintech Sandbox Demo Day will take place on April 28. The presentations will be virtual and the event, as always,...